The question is: how do the new rules affect you and your financial goals?

While the industry is undergoing a massive shift, you always have options. We’re happy to walk you through them. In the meantime, here are four reasons you may want to take action before the new rules set in…

Reason #1:

You’re a few months away from buying your first home.

For years now, you’ve been working hard to cut down on expenses and save up for that down payment. The fact is, you’re tired of paying someone else’s mortgage and you’re ready to start investing in your own financial future. If you’ve been thinking about purchasing a home in the coming year, you may be closer to your goal than you realize.

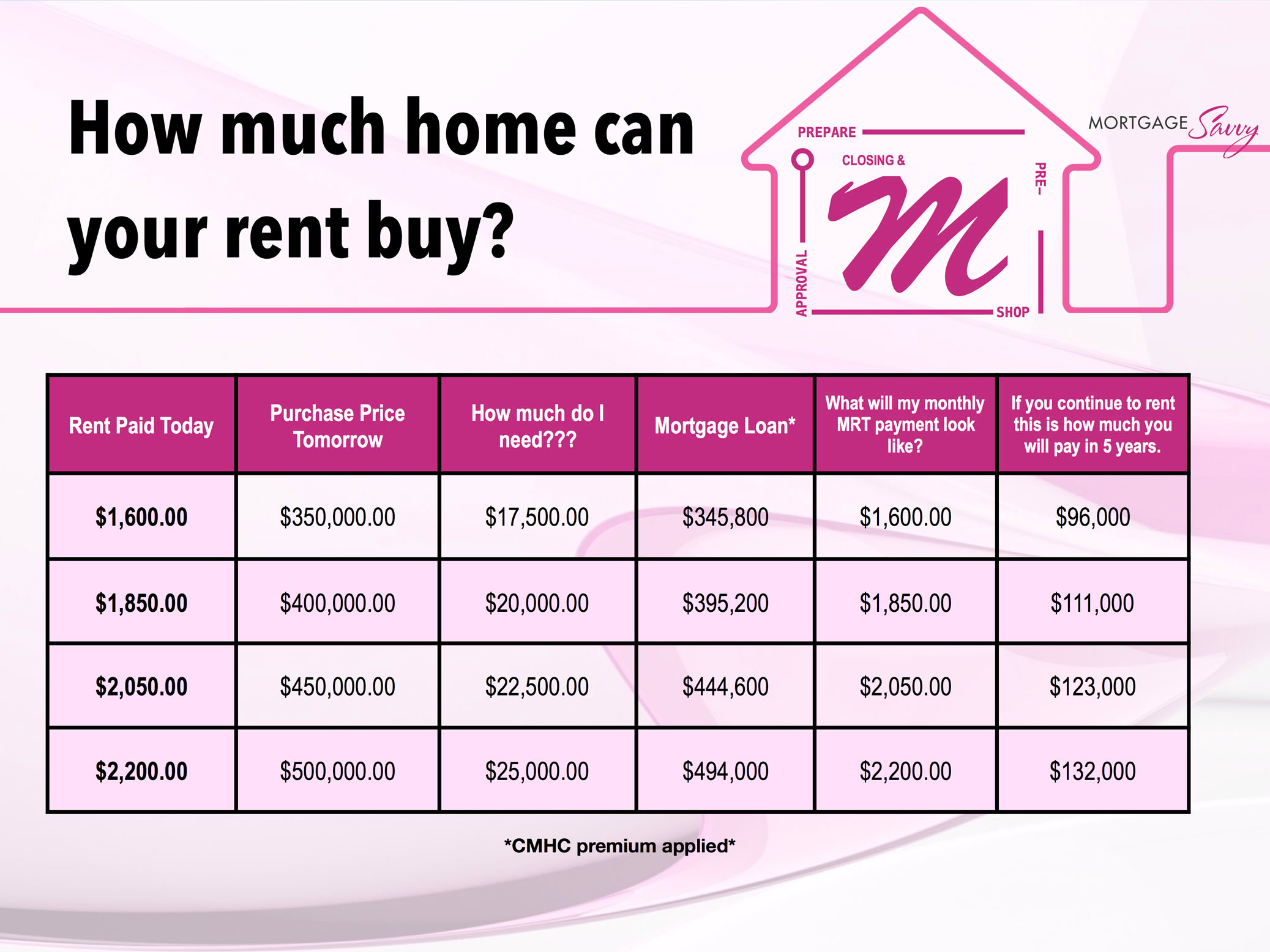

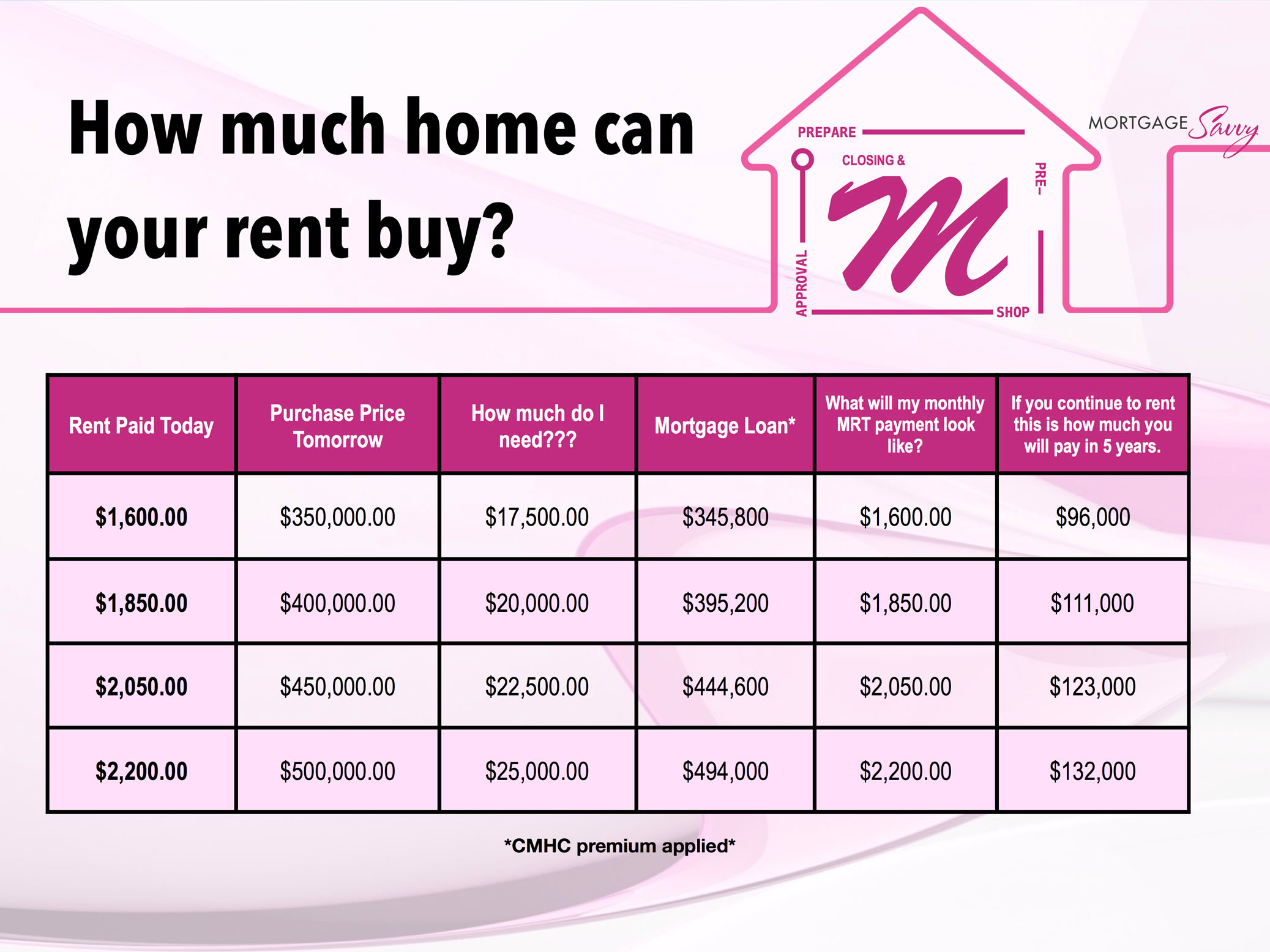

Wondering how much house you can afford? We break it down in the chart below. For more specific numbers, try using our savvy calculator to determine affordability based on your current income and budget.

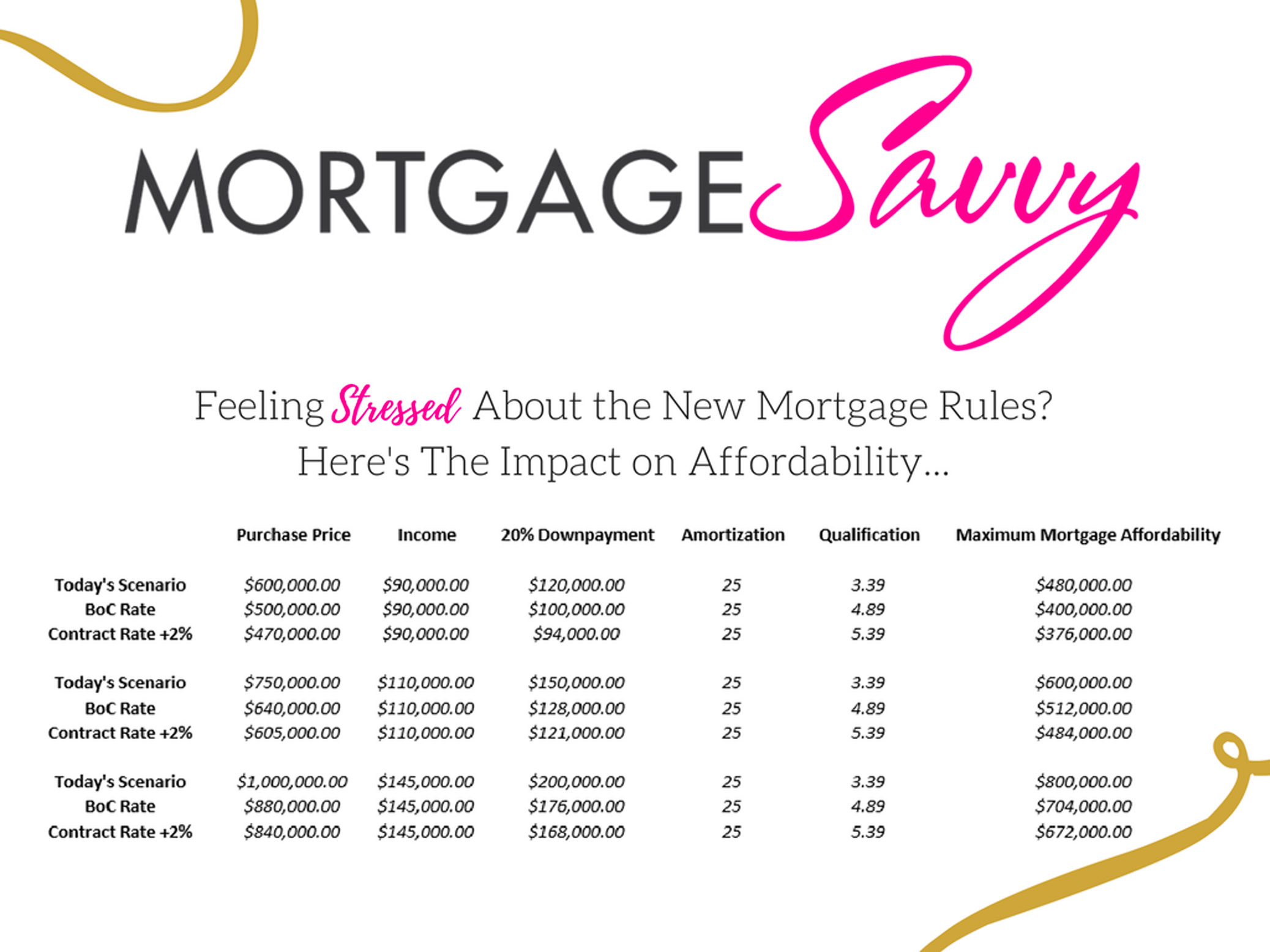

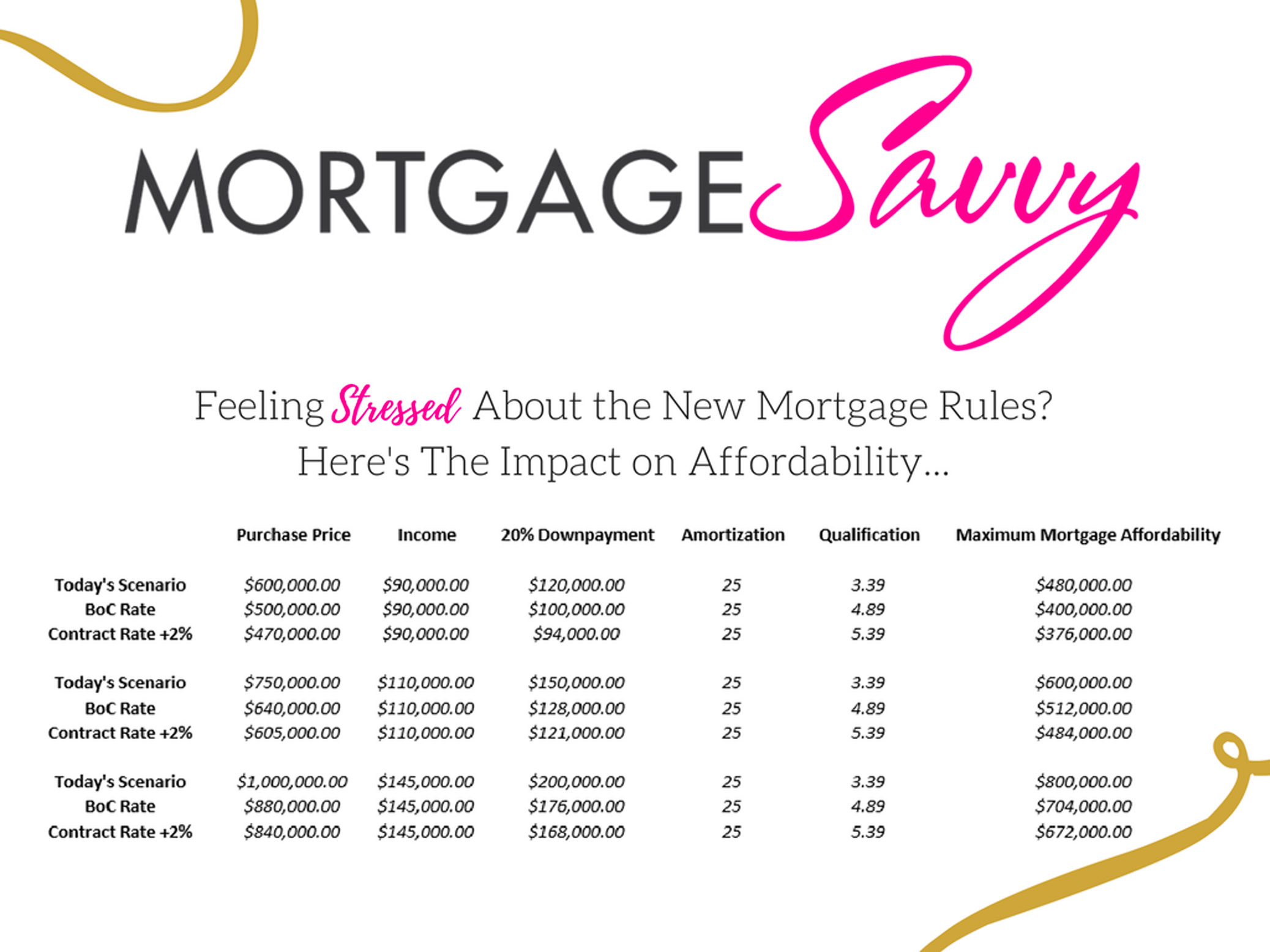

Of course, these numbers are all about to change. As of January 1st, 2019, your maximum mortgage affordability will drop. We summarize the impact in our affordability chart here.

Wondering if this is the time to make the leap into home ownership? Fill out our online application to determine if now is the time to buy your first home.

Reason #2:

You have some debt to pay off (or large expenses coming up).

Perhaps your kids are heading off to university, or you are looking to free up some extra cash to cover home renovation expenses. Refinancing allows you to tap into your home’s equity to pay off debt while taking advantage of lower interest rates. In fact, you can refinance up to 80% of your home’s value to pay off unsecured debts, renovation debt, or to simply access cash.

If your debt is weighing you down, this may be your best opportunity to make a change. Fill out our quick and easy online application form and we’ll help you determine if refinancing before the January 1st deadline is the right option for you.

Reason #3:

You’re ready to upgrade.

As your family grows, so does your lifestyle. Right now, mortgage rates are at a historical low – we’re talking 1.99% for a variable five-year mortgage rate in Ontario. At this rate, a family buying a home for $500,000 with a $125,000 down payment could expect to have a monthly mortgage payment of $1,743.

But as of January 1st, that same buyer will have to undergo a stress test prior to qualifying in order to ensure they can afford to pay their mortgage at two percentage points higher (3.99%). This means they would have to show they can afford to pay a mortgage of $2,165 per month. That’s a difference of $422 a month – or $5,064 a year!

(Refer to “Chart B” above for the full breakdown of the impact on affordability). If you’ve been thinking about making a move, it may be in your best interest to secure a mortgage pre-approval before the new mortgage rules kick in.

Reason #4:

You’re looking to make an investment purchase.

By now you know, it’s about to become tougher to qualify for a mortgage. No matter how you look at it, your purchasing power will decrease when the new rules come into effect January 1st.

If you’ve been considering financing an investment property, doing so before the deadline could mean the difference of owning up to 20 percent more house (as opposed to waiting until 2018 to purchase). Take a few minutes to fill out an online mortgage application today, and we’ll get back to you right away with the answers you’re looking for.

While the January 1st deadline is fast approaching, we want you to remember: it’s not just about the numbers. Even if you’re not in a position to purchase before the January 1st deadline, you still have options.

We’re here to discuss your short and long-term financial plan, so we can help you make the decisions that are right for your personal situation. And we promise we would never make a recommendation we wouldn’t suggest for our own family members. Get started by filling out an online mortgage application, and we’ll take it from there.